Multi-academy trusts have continued to expand and enjoyed a record boost to their finances over the past year amid the pandemic, new research shows.

The academy sector is in “very robust financial health” despite the challenges of dealing with Covid, according to the 2022 Academies Benchmark report, published today.

Here are some of the main findings from the annual poll of more than 300 trust clients of the Kreston Academies Group, a network of accountancy firms.

MATs grow but SATs decline

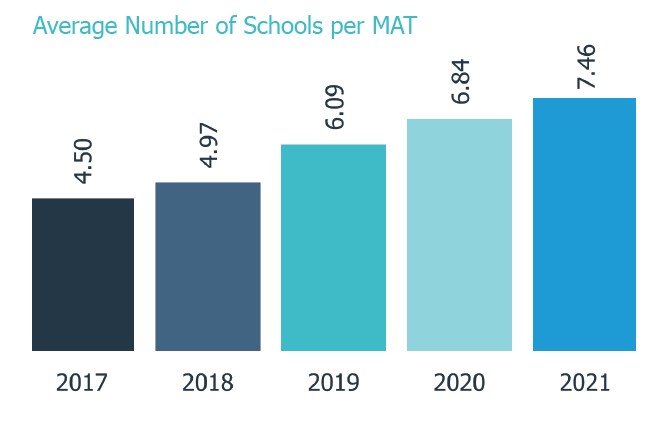

The average size of existing MATs has continued to rise, from 6.8 per trust in 2020 to 7.5 last year. Almost two-thirds of trusts expect to grow next year.

But the number of academies overall rose only 2.5 per cent amid Covid disruption. The number of single-academy trusts also continued to fall, but at a slower rate than last year.

It underlines how Covid has hampered the government’s drive for maintained and standalone schools to join MATs, with MAT-to-MAT transfers or mergers instead accounting for much expansion.

Warwick Sharp, the Education and Skills Funding Agency’s academies and maintained schools director, told the Public Accounts Committee this week ESFA “wants to see fewer single-academy trusts”.

New MATs also appear increasingly rare, with only two more MATs in 2021 than a year earlier.

Surpluses double to record high

The average surplus among MATs jumped to their highest in the decade since the report began, reaching £467,000 – up 94 per cent on last year’s also-record £221,000 surplus.

The research chimes with recent Schools Week analysis of major trusts’ accounts, with some enjoying multimillion-pound windfalls linked to Covid.

Only 3.8 per cent of trusts saw cumulative deficits, down from 8.2 per cent two years previously.

At academy level, secondary and primary finances both remain better than pre-Covid in 2019, though primary surpluses slipped from 2020’s £25,000 to £14,000 last year.

The report called the gains “remarkable”, with lockdowns showing it is “much cheaper to close a school than keep it open” as trusts saved on bills, supply, exam fees and cleaning. “Savings have far outweighed the losses,” the report added.

Sharp told MPs the government was already challenging trusts with high reserves not designated “for a good reason” to spend more on current pupils. “That normally changes behaviour.”

Yet authors expect trusts to spend surpluses next year on catch-up, predicting a hiring spree could push up salaries. Rising energy costs and salaries will also eat into budgets.”All is not as rosy as it seems,” according to Pam Tuckett, Kreston’s chair.

GAG pooling increasingly common

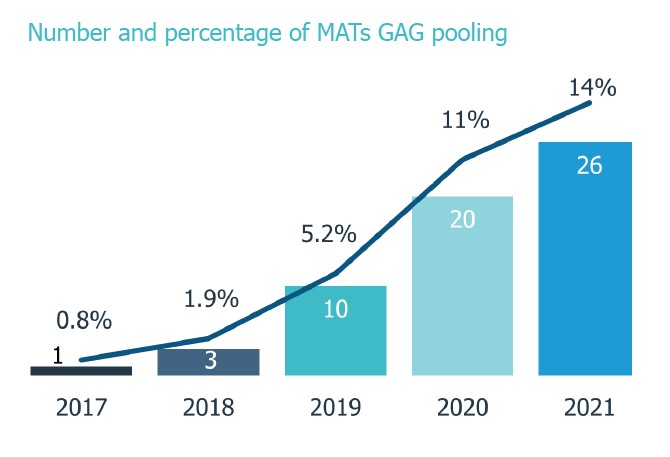

Some 14 per cent of MATs now pool general annual grant funding, meaning “income is controlled centrally with each school funded based on their needs”.

It marks a significant increase on the 5.2 per cent seen two years previously and 11 per cent in 2020.

The report says adopting this remains “sensitive”, noting: “Whilst this may help the trustees of MATs focus on those schools with the greatest need, there is a perception that in the short term some schools will gain and others will lose out.”

But only three per cent of trusts have not centralised some services.

Big trust CEO pay at record high

Average pay packets have reached £150,000 for the first time among large trust chief executives or most senior leaders with other titles, the survey suggests.

Mean pay had stood at around £142,000 two years previously and actually fell to £140,000 in 2020, before a £10,000 jump among trusts with at least 5,000 pupils.

Average CEO salaries stood at £106,000 among trusts with 1,000-2,500 pupils, and £84,000 among those with fewer than 500 pupils.

School business manager salaries have also seen “upward pressure” amid high demand.

Meanwhile the report warned at a challenging time for the sector and after a public sector pay freeze, salaries “may need to rise” to recruit teachers.

This all seems so wrong, I realise it has been an extraordinary couple of years but just the talk of windfall and increases in CEO pay doesn’t sit right with a state education system. I hope we see more action on obscene CEO pay as the government tries to claw back money.